Alberta Quarcoopome Profile

She is currently the CEO of ALKAN Business Consult Ltd, a consultancy which trains staff in the financial services, as well as in other services sectors.

She is an adjunct Facilitator at the Chartered Institute of Bankers, the National Banking College and China-Europe International Business School, (CEIBS).

She also has to her credit, three publications:

(i) “THE 21ST CENTURY BANK TELLER – A STRATEGIC PARTNER” published in March 2015.

(ii) “MY FRONT DESK EXPERIENCE: A YOUNG BANKER’S STORY”, published in July 2016.

(iii) “THE MODERN BRANCH MANAGER’S COMPANION” published in March 2021.

As a columnist of “THE RISK WATCH” series, she has been writing about risk management in the Business & Financial Times Newspaper since October, 2013, with over 300 articles to date. She is also the recipient of the 2014 National Women in Banking and Finance Awards, for Finance/Banking Education category.

As a trainer and thought leader, she uses her banking experience and practical case studies to facilitate training programs in operational risk management, sales, customer service, banking operations, ethics and fraud. Her current passion is motivational speaking and mentoring young professionals to strive for excellence.

Alberta is a Chartered Banker and Fellow of the Chartered Institute of Bankers, Ghana. She also holds a BA, (Sociology & Geography), from the University of Ghana, EMBA, from Ghana Institute of Management and Public Administration, (GIMPA), Certified Microfinance Expert from Frankfurt School of Finance and Management, and Certificate in Women in Leadership and Entrepreneurship, from China-Europe International Business School, (CEIBS).

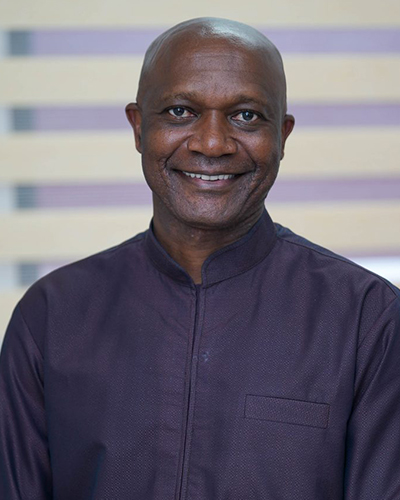

Kwame Owusu-Boateng Profile

Kwame has twenty-two (22) years professional experience which covers International Trade Finance, Banking Operations, Micro Finance, Marketing, and Executive Management. He joined Opportunity International Savings and Loans in 2006 from a private International Trade Finance firm.

Kwame was the first Branch Operations Officer recruited by Opportunity International in Ghana. Between 2009 to 2012 he managed several Management positions until his appointment as acting Chief Executive Officer (CEO) in 2012. He was confirmed by the Board as the first local CEO of Opportunity International Savings and Loans in August 2013. His key strengths are in Strategic Sales Management, Operations Management, Marketing, Communication, and Effective Leadership. He has the skill of building successful teams and energizing them to achieve great results.

He is a graduate from the University of Cape Coast, Ghana with a BSC degree. Additionally, he has an Executive MBA from Kwame Nkrumah University of Science and Technology in Kumasi, Ghana. Kwame has attended various executive programs, some of which includes The Boulder Microfinance Training Program in Turin, and a certificate program in Strategic Management in Micro Finance from Harvard Business School, Boston. He has also attended the African Board Fellowship program organized by Accion International in Cape Town, South Africa and Corporate Governance for Business Executives training program organized by Quest on the Frontier in Dubai. He has additionally attended a Strategic Management course for Micro Finance Practitioners organized by the Micro Finance Association in Washington DC as well as a program from the Frankfurt School of Finance and Management on, “leading with impact”.

Tineyi Mawocha Profile

Tineyi serves as Opportunity’s Chief Program Officer and Africa Regional Director of Opportunity International USA. He oversees operational partnership management and supports business development for the region through high-quality program strategies, concepts, and proposals for resource mobilization.

Tineyi previously held the Chief Executive Officer role at Opportunity Bank Uganda Limited. He joined Opportunity International in 2014 as CEO of Urwego Opportunity Bank (UOB Rwanda), moving to Opportunity Bank Uganda Limited in 2016.

Before becoming part of the Opportunity team, Tineyi served as CEO at Standard Bank Swaziland for seven years. Earlier in his career, he worked in hospitality management in the United Kingdom and Zimbabwe, and in finance as the Branch Network Director at Standard Bank South Africa. He also briefly worked as Managing Director at Tetrad Investment Bank as well as Afrasia Bank in Zimbabwe, his home country.

Tineyi earned a Master of Development Finance from the University of Stellenbosch Business School and a Master of Business Administration from the University of Zimbabwe Graduate School of Business and a certificate in Strategic Management in Microfinance from Harvard Business School, Boston.

He was an advisor for Accion’s Africa Board Fellowship Programme and is a non-executive director on the board of Opportunity Bank Uganda as well as Vision Fund DRC and is on the Governing Council for Waterford Kamhlaba (United World College of Southern Africa UWCSA), as well as a member of the Board of Trustees for Opportunity International UK.

Benjamin Kwasi Kusi Profile

Mr. Kusi has a wealth of experience in strategic, operational, policy and controls formulation and implementation to achieve goals and build sustainable businesses.

Benjamin’s experience spans over 24 years in the development and implementation of IT Enterprise Solutions and policies in line with company objectives, processes and procedures. He has managed various high-profile projects including large scale multi-million-dollar IT Enterprise projects in Ghana’s NHIA (National Health Insurance Authority), Bank of Ghana, NHS Trusts and University of Westminster in United Kingdom.

Benjamin has extensive training and experience in IT governance, IT Infrastructure Library (ITIL) for IT service delivery, IT security, IT infrastructure and Data Centre management. He has designed integrated solutions such as ERP (Enterprise Resource Planning) and controls to mitigate risks within NHIA.

Benjamin is a member of the Entity Tender committee of NHIA for more than 12 years ensuring cost containment and prudent purchases using cost benefit analysis approach.

Benjamin has deep understanding and application of corporate governance principles and directives. He developed and implemented standard operational processes and procedures at the Regional and District Offices of NHIA, that has led to high level of efficiency.

Benjamin holds a Degree in Electronic Engineering from Middlesex University and postgraduate in Information Systems Design from University of Westminster, both in the United Kingdom. He also had Leadership Strategies training at Harvard Kennedy School of Executive Education and also an Executive training at Corporate Business PLC, UK.

Hajia Azara Abukari-Haroun Profile

Hajia Mrs. Azara Abukari-Haroun is a professional Chartered Banker (retired). She is currently the CEO of an NGO called Zakat and Sadaqa Trust Fund of Ghana, which works toward alleviating poverty through the provision welfare services to the needy.

Her educational qualifications include a Bachelor’s Degree from Open University UK, an Executive MBA, (Finance Option) from University of Ghana as well as an Associateship with both the Chartered Institute of Bankers UK and Ghana. She has also attended various short courses including but not limited to Strategic management, Change Management, Public Sector Administration, Equal Opportunity and Discrimination, Emotional Intelligence etc etc.

After her University, Mrs. Abukari-Haroun worked initially with the London Borough of Hackney in the UK where she held various positions from Total Quality Control Officer through to Benefits Finance Officer for over ten years.

She moved back to Ghana in 1996 and began a career in Banking at the then Home Finance Company (HFC), a Non-Bank Financial Institution at the time as a Mortgage Finance Officer. She was one of the officers who worked tirelessly to help the HFC metamorphose into a fully-fledged Universal Bank and was appropriately appointed its very first Branch Manager when the then HFC Bank Ghana Limited was fully established. She rose through the Banking mill to become the Head of Institutional Banking of the HFC Bank, now Republic Bank, Ghana.

Hajia Azara’s experience in Banking and Finance spans over a thirty-year period, and includes, but not limited to social benefits finance, deposit taking, mortgage financing, credit appraisals, administration, marketing, branch banking, risk management as well as social and organizational change management. These have instilled in her a deep understanding and knowledge of the Ghanaian Banking Industry and importantly, Corporate Governance issues.

Hajia Azara serves on other Boards of these Institutions: Zakat and Sadaqa Trust Fund, SSNIT Guest House, Ghana Road Fund, Opportunity International Savings and Loans company. She’s married and has two grown up daughters and several fostered children.

Hajia Azara enjoys as hobbies, hands-on Community development, Charity work, Counselling, Family management, reading, walking and swimming.

Joyce Boeh-Ocansey Profile

She also served as an executive head-hunter, working on high-profile recruitment projects for clients across a wide portfolio of industries. Joyce has over thirty years of experience in General Management, Executive Headhunting & Recruitment, Business Development, Project Management, Public Relations & Communications and High-level Stakeholder Management, across the consulting, publishing, media and education industries.

At a critical time in the life of the state-owned company, New Times Corporation, she was appointed CEO to lead a major business restructuring and turnaround. She successfully led a transition team that returned the company to operational stability. She also served on the organization’s Editorial Board.

Joyce served on the Fund Raising Committee of the Accra Ridge Church and was formerly an Executive at the Accra Ridge Church Manet Chapel Women’s Fellow. She currently serves on the Advisory Board of Legacy Girls College.

She holds a Graduate Diploma in Journalism and Mass Communication from the College of Journalism, United Kingdom and has attended several professional development programmes, building management and leadership capacity.

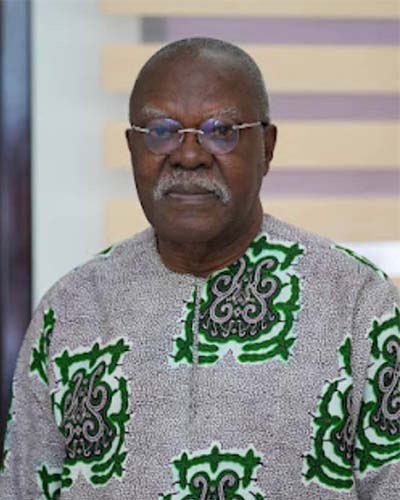

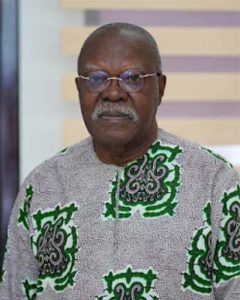

Arnold Ekpe's Profile

Mr. Arnold Ekpe is an accomplished banker with over 30 years’ experience building successful African and international financial institutions. He is well known for transforming the Ecobank group from a West African bank to Africa’s largest Banking group with a presence in 35 Sub-Saharan African countries, Europe, Middle East and Asia.

Mr. Arnold Ekpe is an accomplished banker with over 30 years’ experience building successful African and international financial institutions. He is well known for transforming the Ecobank group from a West African bank to Africa’s largest Banking group with a presence in 35 Sub-Saharan African countries, Europe, Middle East and Asia.

On his retirement in 2012, Mr. Ekpe and the Ecobank Group were respectively awarded the “Lifetime Achievement Award” and the “African Bank of the Year Award” by the African Banker.

Mr. Ekpe is a key proponent of financial inclusion, driven by the conviction that improving the quality and standard of the poor, low income and SMEs will be critical to future sustainable economic growth in frontier and emerging markets. Through his philanthropic work, he is actively engaged in supporting aspiring entrepreneurs, serving on advisory councils and boards, and investing in ventures in these markets.

Mr Ekpe sits on the board of Opportunity International Savings and Loans Ltd as a shareholder representative of KDB Fintech Limited. He also currently serves as: NED, KDB Fintech (UK); Chairman, Baobab Group (Pan-African microfinance company); NED and Chair of the Audit & Risk Committee, Dangote Group (Nigeria); NED and Chair of the Governance & Strategy Committee of the Pan-African Payment and Settlement System (“PAPSS”).

He holds a Bsc in Mechanical Engeneering from the University of Manchester and a Masters in Business Administration from Manchester Business School.

Pryce Kojo's Profile

Mr Pryce Kojo Thompson is a former banker. He retired from SSB Bank in 2003 after 15years at the bank’s helm of affairs. During his tenure as Chief Executive, he led the management team which restructured the then Social Security Bank from its distressed state in the 1980s through its turnaround

into a viable, attractive institution. This enabled the bank to be subsequently listed on the stock exchange and privatized to a majority foreign-owned entity in the late 1990s. Along the way, he successfully

accomplished the then only merger of banks ever done in Ghana.

Prior to his time at the bank, he had held the position of Managing Director of Achimota Brewery Company for about a year and a half. Before that, he worked as a Management Consultant in both private and public consultancy establishments.

His academic background covers studies in Economics as well as Business Administration, in Ghana, Japan and Britain. These culminated in an MBA from the University of Bradford, UK.

Ken Wathome's Profile

Ken Wathome is a serial entrepreneur and philanthropist with interests in real estate, insurance, and the technology space. He was the founding chairman of Faulu Kenya Bank, one of Kenya’s leading microfinance institutions, and has chaired several public sector, private sector, and non-profit boards, including the Kenya Bureau of Standards, Transformational Business Network (East Africa), and Food for the Hungry International. He has served on numerous boards both in Africa and internationally and continues to contribute his expertise.

Mr. Wathome currently represents the majority shareholder on the Opportunity International Savings and Loans Ltd.’s board and he chairs the Stewardship and Impact Committee on the Opportunity International US board.

He holds an MBA from the United States International University in Kenya and is an alumnus of Harvard Business School’s Owner/President Management (OPM) program.

.